Time tracking is important for any business to be successful. It provides important details to ensure you’re compensating employees correctly, billing clients accurately, and hiring or scheduling workers at the correct frequencies. Time tracking can also provide big-picture information on the success of your business and team. This article will specifically look at the different employee classifications per U.S. law and how time tracking is required (hint: if overtime is a concern, keep reading!).

Whether you have exempt or nonexempt employees, time tracking is essential. However, if you have nonexempt employees (usually employees paid on an hourly basis), it becomes especially important in order to avoid the dreaded overtime pay. For exempt employees (usually salaried employees), time tracking can also still have merit for insight into your business (such as how to price services and how to bill clients).

This article will describe:

- The Difference between an exempt & nonexempt employee;.

- An example of an hourly employee: "Rusty Retail Store;"

- An example of a salaried employee: "Classy Consulting;"

- How to decide when an employee should be classified as hourly (exempt) vs. salaried (nonexempt); and

- Time tracking and the basic legal requirements pertaining to the practice.

The Difference Between Exempt and Nonexempt Employees

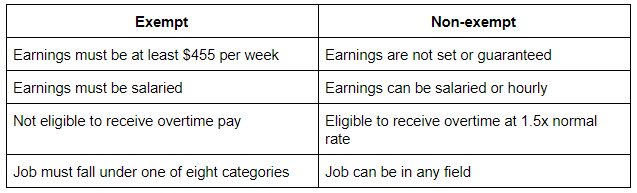

Most easily explained in a table form, let’s look to the below to review the four primary differences between exempt or nonexempt employees:

So, as you can see, tracking the time of nonexempt employees is critical in order to determine their pay and if they have exceeded the overtime threshold.

Let’s take a few examples to provide a bit more color on the situation.

Example 1: Rusty Retail Store

The Rusty Retail is a hardware shop in Dearborn, Michigan. It is open seven days per week from 9 a.m. until 5 p.m. and has about 20 hourly paid employees to cover its shifts.

The shifts include:

- 8:30 a.m. - 2 p.m: Opening Cashier

- 1:30 p.m. - 6 p.m: Closing Cashier

- 8:30 a.m. - 2 p.m: Opening Floor Attendant

- 1:30 p.m. - 6 p.m: Closing Floor Attendant

- 7 a.m. - 12 p.m: Stock & Inventory Attendant

- 8:30 a.m. - 3 p.m.: Morning Manager

- 1 p.m. - 6 p.m.: Evening Manager

As you can see, each shift is less than eight hours, which means the employees at Rusty Retail are not usually full time, which is why a salaried approach doesn’t make sense. However, in commerce businesses, like retail stores, people pick up extra shifts when others call in sick, go on vacation, or during busy seasons, like Christmas. Thus, all of the employees at Rusty Retail are nonexempt and eligible for overtime -- even the managers.

Time tracking is crucial at a business like Rusty Retail in order to avoid excess costs like overtime as well as to make decisions about hiring or laying off a worker and determining payroll.

Example 2: Classy Consulting

Classy Consulting is a management consulting firm located in Los Angeles. It has 10 employees who are all salaried and work in the company's office. All of the employees are salaried at $70,000 per year or more.

Classy Consulting is an example of a business whose entire employee base is considered exempt from overtime. While all employees generally work at least 40 hours per week (or more if a client requires it), they are not eligible for overtime due to the amount of money they earn, the fact that they are salaried, and the nature of their work (office setting).

Hiring Exempt or Nonexempt Employees

What if the company Classy Consulting decides to hire a part-time marketing manager? This is a great example of when exempt versus nonexempt can become confusing. A marketing manager in Los Angeles, even when part time, would likely make $40 per hour (or more). If that person is working 20 hours per week, then they are making well over the $455 per week threshold. But, wait- they are paid hourly? So, then, are they exempt or nonexempt? Let’s backtrack for a second.

There are some requirements from the U.S. Department of Labor that may require certain administrative, executive, and professional roles to be exempt. If there is no requirement in place, it can be helpful to look at the hours an employee will be working. If the employee is part-time with fluctuating hours, nonexempt may be the best option. However, if an employee is working full-time hours or very consistent part-time hours, salaried would likely be better. It ensures consistent pay for the employee while avoiding the extra expense of overtime hours. Thus, Classy Consulting could consider making its new marketing manager a part-time salaried employee to try to avoid this issue. Failure to properly classify an exempt and nonexempt employee can result in adverse effects.

Time Tracking: Legal Requirements For Nonexempt Employees

Here it is, in black and white: What you need to do for nonexempt employees:

According to the Department of Labor, any time worked by nonexempt employees must be tracked by the hour and recorded by the employer under the Fair Labor Standards Act (FLSA). There is no mandated time tracking system as long as it maintains accurate records. Nonexempt employees must be paid at least minimum wage and are required to receive 1.5 times their hourly rate for any hours worked past 40 each week.

On the other hand, Exempt employees are paid a fixed salary and are not eligible for overtime pay, even if they work beyond 40 hours in a workweek. Employers can choose to track exempt employee time for billing clients or payroll and benefits administration. If an employer chooses to track hours for an exempt employee, the employee must comply. For exempt employees, an employer can choose a schedule and hold employees working a certain number of hours a week. If the employee does not work all hours required, the employer cannot deduct pay but address the issue through disciplinary measures.

Conclusion to Tracking Employees’ Time

Every business can find merit in exempt versus nonexempt employees. For example, the Rusty Retail may decide to make a manager salaried if the employee holds a consistent schedule. Understanding labor laws and how to track time remain crucial in avoiding penalties.

Read more content like this

Check out the other posts we have written related to this article.