Payroll for Small and Medium Sized Businesses

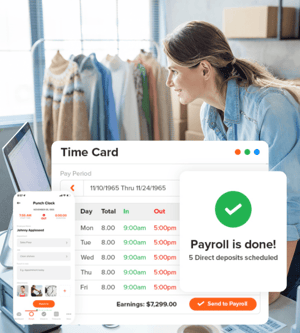

Run Your Payroll in 2 Minutes or Less!

Manage employees and contractors from one platform. Track hours, run payroll, and auto-generate W-2s and 1099s all in the same system.

More Than 18,000 Companies Trust OnTheClock

Efficiently manage your workforce from a single platform

Consolidate Your Time and Payroll in One Platform

Streamline scheduling, time tracking, and payroll into one program: One app, one tap, total control.

- Track time, facilitate employee schedules, and execute payroll, all from one platform. No more third-party exports, manual mistakes, or security breaches.

- Consolidating platforms will reduce your HR team’s administrative responsibilities.

- Regain full control of your payroll process, never having to rely on (or pay) a third-party again.

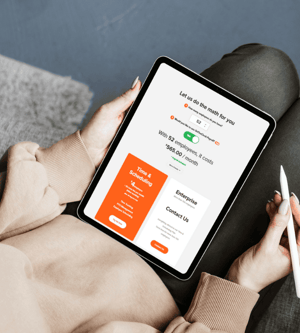

No Hidden Fees

OnTheClock Payroll costs $40 per month (base fee) and $6 per worker, whether the individual is a W-2 employee or a 1099 contractor. That’s the exact amount you’ll pay each month.

- No contracts – Payroll is billed month-to-month.

- No hidden fees or upcharges for W-2s, 1099s, direct deposit, off-cycle pay runs, or customer support.

- Automatic year-end forms included: W-2s for employees and 1099s for contractors.

- Benefits, garnishments, and any other pre- and post-tax deductions are processed at no charge.

Let Us File Your Taxes for You!

With OnTheClock Payroll, we facilitate your payroll processing, as well as your quarterly and annual taxes—on time, every time.

- Eliminate the burden of manually preparing and filing your company's taxes.

- Employees’ taxes will be deducted automatically from their gross paychecks.

- Quarterly tax payments, such as Forms 940, 941, and annual W-2 wage reportings, are included.

- Whether you’re filing W-2s or 1099s, we generate and file your year-end forms on time – at no extra cost!

All-in-One Payroll for W-2 Employees and 1099 Contractors

Now you can pay both employees and contractors from the same platform—no extra tools or add-ons needed.

- Track contractor hours side-by-side with W-2 employees.

- Automatically generate 1099 forms at year-end.

- Pay contractors through direct deposit with no hidden fees.

- Stay compliant with accurate reporting for both employees and contractors.

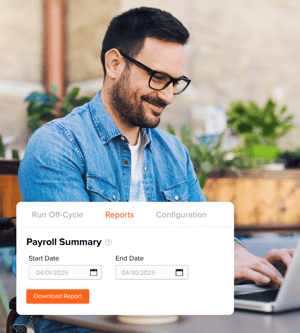

Customizable Payroll Reports

OnTheClock provides customizable reports that show every penny that’s extracted from each employee’s paycheck.

- All payroll information – salaries, taxes, benefits, and more – is included on one document.

- Reports can be customized to reflect any timeframe (weekly, biweekly, monthly, quarterly, annually, etc.).

- Employers can run unlimited payroll reports at no extra cost.

- Reports offer valuable KPIs, such as average wage per employee, turnover rates, overtime costs, and more.

How to Enroll in OnTheClock Payroll (in 15 Minutes or Less!)

Sign up directly inside your account or connect with a payroll expert to discuss your unique business needs and see OnTheClock in action.

Our dedicated team will guide you through setting up your account, ensuring everything is configured perfectly.

We'll help ensure a smooth and secure transfer of your existing payroll data, minimizing any disruption.

Start processing payroll with the peace of mind that comes from our ongoing expert support.

Complete Payroll Quickly, Easily, and Affordably

What Our Customers Are Saying

"There is a huge difference in time it takes to run payroll now…the longest it takes is maybe 10 minutes and that's only if we have any bonuses to input.. Having the benefits broken down helps for our Simple IRA data entry saves me additional time."

Featured OnTheClock Payroll Webinars

Tired of hidden fees, poor support, and complicated products. Make the switch today!

Small business payroll doesn’t have to be a headache—discover how OnTheClock makes it faster, easier, and stress-free.

In this eye-opening webinar, we expose the hidden fees and secret costs that payroll companies don't want you to discover. ...

Discover how OnTheClock's revolutionary payroll solution is transforming small business operations in 2025.

Discover how OnTheClock Payroll outperforms QuickBooks for small businesses in 2025.

Discover why small businesses are switching from Paychex to OnTheClock's integrated payroll solution.

Don't let outdated systems drain your resources. See how OnTheClock can revolutionize your payroll management in 2025.

Learn how one customer saved $1,200 annually while simplifying their payroll process.

Everything You Need In One Place

FAQ

OnTheClock Payroll is available for a monthly fee of $40 per company and an additional $6 per employee. A $250 migration fee, due at signup, includes importing historical employee, company, and payroll data; connecting your company’s bank account; and conducting an audit to ensure complete accuracy.

OnTheClock Payroll automates the payroll process by importing employee hours tracked directly through OnTheClock’s time tracking system. Users can review, approve, and process payroll with just a few clicks, making it simple to manage payroll for your team.

To get started, sign up for an account on our website. Once you’ve set up an account and input your payment information, OnTheClock payroll may be accessed through the Payroll icon. For those new to the software, visit OnTheClock Payroll directly for more information at https://www.ontheclock.com/payroll.aspx. If you’re already utilizing a paid OnTheClock account, simply login to your account and click the payroll icon.

OnTheClock Payroll was built through a partnership with Check, a payroll institution trusted by 15,000-plus employers and 180,000-plus employees nationwide. Check has processed more than 300,000 payrolls and securely moved $4 billion in payroll funds, ensuring the reliability and accuracy you’d expect from an industry leader. By partnering with Check, OnTheClock Payroll is built on years of refined expertise, minimizing risk for your business.

OnTheClock Payroll was built through a partnership with Check. Check’s dedicated compliance team monitors real-time updates to labor laws, tax codes, and reporting requirements. This expertise is embedded into OnTheClock’s platform, automating withholdings, filings, and audits. Check has processed more than 300,000 payrolls and helped resolve complex compliance challenges for businesses across industries. This ensures you, as an OnTheClock user, remain ahead of any and all regulatory shifts.

Absolutely. Our infrastructure, powered by Check, supports businesses ranging from startups to enterprises. Check has managed payroll for 180,000-plus employees, and that number is growing every day. Whether you’re expanding teams, entering new states, or opening a new location, OnTheClock’s platform is designed to adapt seamlessly while maintaining compliance and accuracy — no matter how large your business becomes.

With OnTheClock Payroll, businesses avoid the fees associated with hiring external payroll providers, which can result in significant time and cost savings, especially for small to mid-sized businesses.

Yes. OnTheClock’s support team will be available to help customers with any questions or concerns they may have.

Absolutely. OnTheClock takes data security seriously and implements robust security measures to protect all employees’ personal information and payroll data, including encryption and secure access protocols.

We will handle your whole payroll migration. Our expert team makes this process a breeze! We do require a one-time fee for setup and migration of $250. Our team will transfer over all payroll history, including past tax information and employees.

Both pre- and post-tax benefits are supported. These include medical, vision, dental, and disability insurance payments as well as various retirement funds, including 401(k), 403(b), Roth 401(k), etc. The program also supports flexible spending accounts (FSAs) and health savings accounts (HSAs) for both medical and dependent care.

Yes. The program will automatically set up and calculate local, state, and federal withholdings. If and when tax changes occur, the software will automatically update accordingly.

No. OnTheClock Payroll’s migration service will import all the necessary information. Following the migration process, employees will need to customize their deductions and payment preferences, but, outside of that, switching to OnTheClock Payroll is fairly seamless.

A typical payroll process takes four business days to complete. Accelerated approval (two days) and next-day direct deposit will not be available upon launch.

Adding payroll is easy! Simply log in as an OnTheClock Admin, click on the "Payroll" icon at the top of the page, and then click the "Enroll" button. OnTheClock will walk you through the steps to get your team set up.

Managing payroll internally reduces the number of parties who have access to sensitive employee information, decreasing the risk of data breaches.

Internal payroll enables direct communication between the payroll team and other departments, ensuring timely and accurate updates to employees' statuses, benefits, or deductions.

When payroll is managed in-house, managers can make corrections and alterations quickly and easily. This flexibility ensures that payroll can be adapted rapidly to any and all changing business needs.

Yes. OnTheClock payroll can be extensively customized to meet each business's specific needs, covering reporting requirements, deduction types, tailored benefits, and more.

Yes! OnTheClock makes it simple to run payroll for both W-2 employees and 1099 contractors in one platform. You can track time for each, pay them via direct deposit, and auto-generate their year-end forms (W-2s and 1099s) without extra fees.

It’s up to you. If you pay contractors hourly, you can track their time just like employees. If you pay them per project or flat rate, you can skip time tracking and simply run payroll.

Absolutely. There are no hidden fees. Your monthly base fee and per-worker fee cover both W-2 employees and 1099 contractors, including year-end form generation.

Whether you have employees, contractors, or a mix of both, OnTheClock Payroll keeps everything in one place.

W-2 Employees

- Automatic tax withholding

- Year-end W-2 forms auto-generated

- PTO tracking and scheduling included

- Benefits, garnishments, and deductions processed automatically

- Paid via direct deposit

1099 Contractors

- No tax withholding (contractors handle their own)

- Year-end 1099 forms auto-generated

- Optional time tracking built in

- Simple, accurate payments with no hidden fees

- Paid via direct deposit